The entry is a debit of $10,000 to the cash (asset) account and a credit of $10,000 to the notes payable (liability) account. In this case, you are swapping one asset (cash) for another asset (inventory). The entry is a debit of $4,000 to the fixed assets (asset) account and a credit of $4,000 to the cash (asset) account. This means that you are consuming the cash asset by paying employees.īuy a fixed asset. This is a debit to the wage (expense) account and a credit to the cash (asset) account. When netted together, the cost of goods sold of $1,000 and the revenue of $1,500 result in a profit of $500. This records the elimination of the inventory asset as we charge it to expense. The second entry is a $1,000 debit to the cost of goods sold (expense) account and a credit in the same amount to the inventory (asset) account. This means that you are recording revenue while also recording an asset (accounts receivable) which represents the amount that the customer now owes you. One is a debit to the accounts receivable account for $1,500 and a credit to the revenue account for $1,500. You sell the goods to a buyer for $1,500. The entry is a debit to the inventory (asset) account and a credit to the cash (asset) account. You buy $1,000 of goods with the intention of later selling them to a third party. Here are the double entry accounting entries associated with a variety of business transactions:īuy merchandise. Loss on sale of asset (loss account: normally a debit balance) Gain on sale of asset (gain account: normally a credit balance) Travel and entertainment (expense account: normally a debit balance) Utilities expense (expense account: normally a debit balance) Wage expense (expense account: normally a debit balance) Revenue - services (revenue account: normally a credit balance)Ĭost of goods sold (expense account: normally a debit balance) Revenue - products (revenue account: normally a credit balance) Retained earnings (equity account: normally a credit balance) Notes payable (liability account: normally a credit balance)Ĭommon stock (equity account: normally a credit balance) Inventory (asset account: normally a debit balance)įixed assets (asset account: normally a debit balance)Īccounts payable (liability account: normally a credit balance)Īccrued liabilities (liability account: normally a credit balance) Examples of accounts are:Ĭash (asset account: normally a debit balance)Īccounts receivable (asset account: normally a debit balance) It is positioned to the right in an accounting entry.Īn account is a separate, detailed record associated with a specific asset, liability, equity, revenue, expense, gain, or loss. Credit DefinitionĪ credit is that portion of an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the left in an accounting entry. Debit DefinitionĪ debit is that portion of an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. Double Entry Accounting DefinitionsĪ double entry accounting system requires a thorough understanding of debits and credits. This means that determining the financial position of a business is dependent on the use of double entry accounting. Without double entry accounting, it is only possible to report an income statement. When this happens, the transaction is said to be "in balance." If the totals do not agree, the transaction is said to be "out of balance," and you will not be able to use the resulting information to create financial statements until the transaction has been corrected.Ī key reason for using double entry accounting is to be able to report assets, liabilities, and equity on the balance sheet.

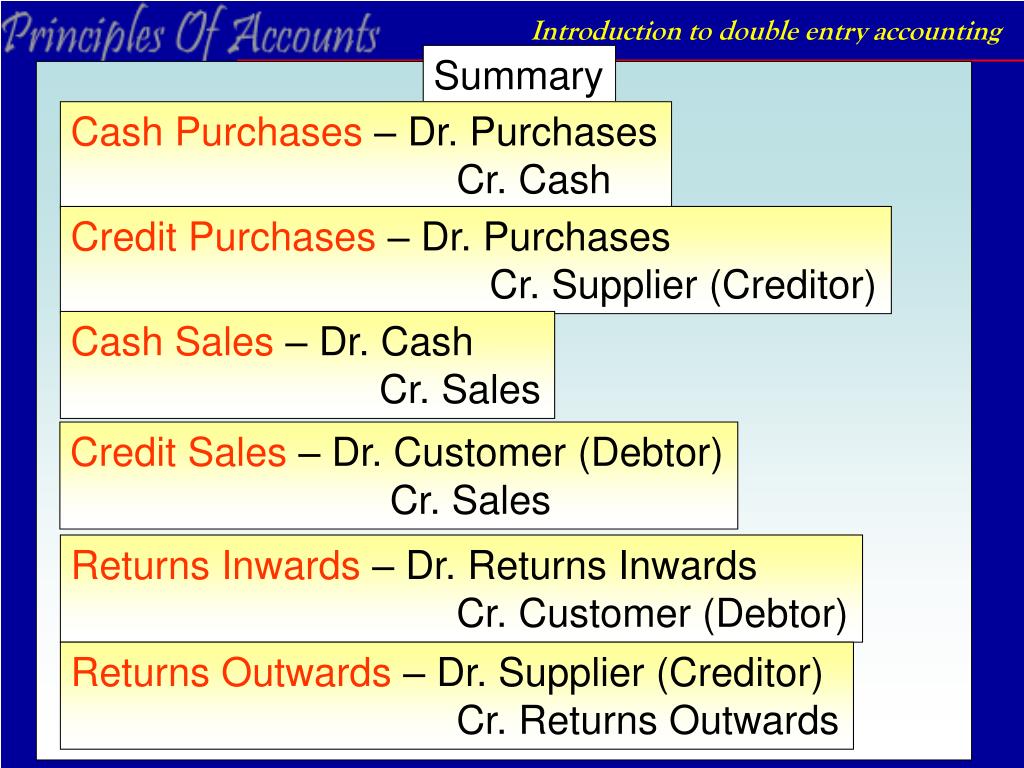

In double entry accounting, the total of all debit entries must match the total of all credit entries. There are two columns in each account, with debit entries on the left and credit entries on the right. Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts. There is no limit on the number of accounts that may be used in a transaction, but the minimum is two accounts.

0 kommentar(er)

0 kommentar(er)